Participatory condominium financing in real estate

By Nicolas Terrier

Who hasn’t wanted to invest in stone?

Real estate is a tangible investment, based on a relatively stable income, but not for everyone. Indeed, this privileged investment has long been inaccessible to the general public. This is because of high barriers to entry, whether because the best opportunities remain between professionals, the wealthy and institutional investors, or simply because the purchase price of a building remains unaffordable for the majority of the population.

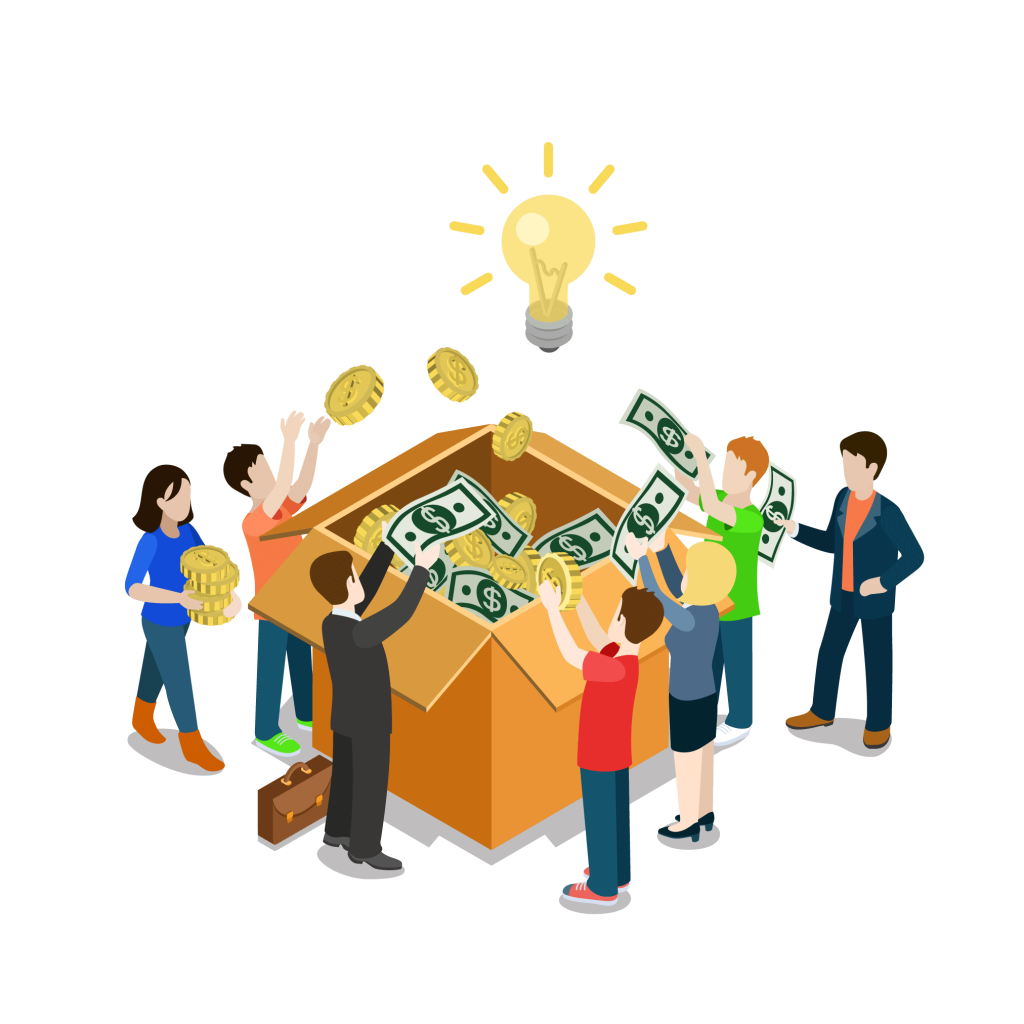

But times are changing, and participatory financing is helping to break down these barriers. This new financing model simply brings together individual investors to pool their funds and invest them in a building with a return. This democratizes real estate investment by allowing everyone to become a direct owner with a small amount of money, thereby reducing risk while increasing return on equity.

How does equity co-ownership financing in real estate work?

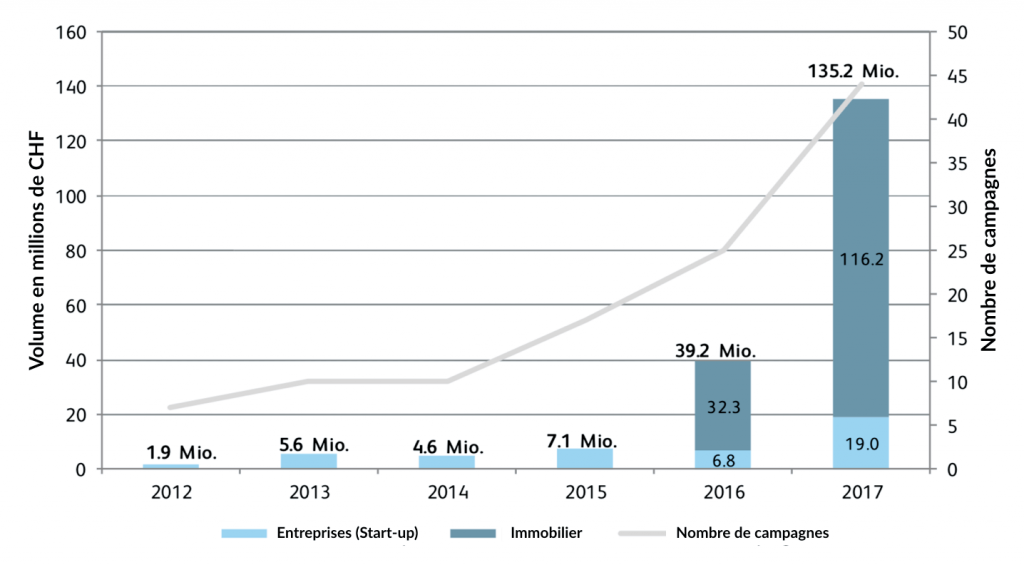

There are several types of equity financing in real estate. The simplest and the most “revolutionary” in Switzerland is participatory condominium financing. Arriving in 2016, this type of investment has tripled in terms of amount, from 32 million raised in 2016 to 116 million in 2017, as shown below.

The principle lies in the fact that each individual becomes the owner in the land register of a part of the building in proportion to his investment. This gives him the possibility to receive net rents, to participate in the potential capital gain in case of resale, and also to take part in strategic decisions.

The total amount of funds raised will constitute the equity for the acquisition of the property, supplemented by a mortgage loan from a banking institution. Don’t panic, this new model decouples the mortgage loan obtained from the banking partner. In other words, each individual is only liable for the amount of debt in proportion to his or her investment. This is akin to owning a miniature building.

What is the difference with condominiums?

This type of co-ownership also differs from the PPE that we are familiar with in Switzerland. Indeed, in a PPE, each owner is the holder of a share which is, according to the rules of the co-owners, linked to an apartment, potentially conferring decision-making differences arising from a conflict of interest relating to the apartment that the owner holds. In the context of participatory co-ownership financing, there is no distinction, each owner owns the entire property to the extent of a fraction. Therefore, the financing platform acts as a support in decisions by providing the co-owners with all the necessary data.

References

Prof. Dr. Andreas Dietrich, S. A. (2018). Crowdfunding Monitoring Switzerland 2018. Institute of Financial Services Zug (IFZ).