Comparison between equities and real estate

By Nicolas Terrier

As the saying goes, “You can’t put all your eggs in one basket”. The principle of diversification is important for any investor, as it helps to optimize the final return. In the financial field, real estate is often compared to equities as a diversification tool, representing an alternative. It therefore seems interesting to compare these two asset classes and to mitigate risk through their correlation.

Main dissimilarities between real estate and equities

First of all, the investment in stone is less liquid. In other words, the process of buying and reselling can take several months, implying higher transaction costs and regulatory specificities. Real estate investment is therefore more difficult to conclude compared to the acquisition of a share in a listed company, where it is often just a click away.

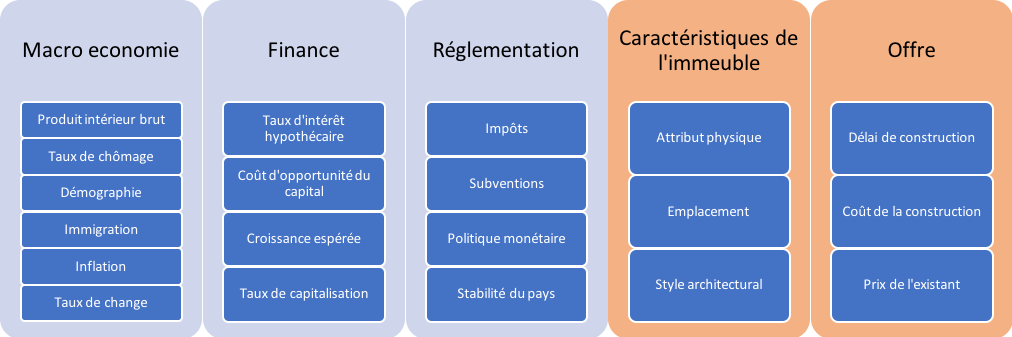

Secondly, a share is easily replaceable and exchangeable, i.e. with high fungibility. A building, for its part, remains unique, whether by its location, its characteristics, or its architectural style.

Another special feature is the income, which is theoretically more stable for real estate since everyone has and will always need a roof over their heads. While a company’s dividends depend primarily on its performance, the economic climate, as well as various decision-making factors specific to the company.

Unique characteristics of real estate

Not all factors that influence the price of investing in stone are broadly similar to equities. Below is a non-exhaustive list of the many factors that have a direct or indirect impact on real estate prices. Note: the orange boxes are the factors that we believe could have a more pronounced influence on real estate.

All these differences have led to certain stability in the fluctuation of real estate prices, constituting a justification for including this asset in a portfolio. This is known as diversification, because if the equity market falls, for example, real estate prices could rise or fall, but not necessarily to the same extent. This will ultimately improve the performance of the portfolio by limiting the damage, like a single basket full of eggs that would overturn with its entire contents versus two baskets half-filled.

Correlation between real estate and equities

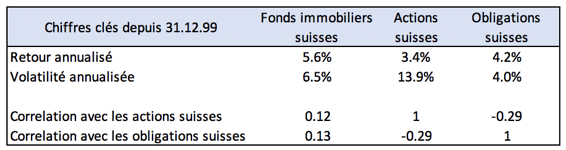

Credit Suisse thus compared the price trends of Swiss real estate funds with those of Swiss equities between 1999 and 2016 to determine the return on investment as well as the volatility (risk) of these two asset classes summarised in the table below.

The observation is simple: over the period analyzed, the volatility of a share price is twice as high for a lower return. In view of the above, and particularly the illiquid nature of the real estate, it is highly likely that this difference is even more evident for directly held real estate, and all the more so in the short term (Kempen, 2017).

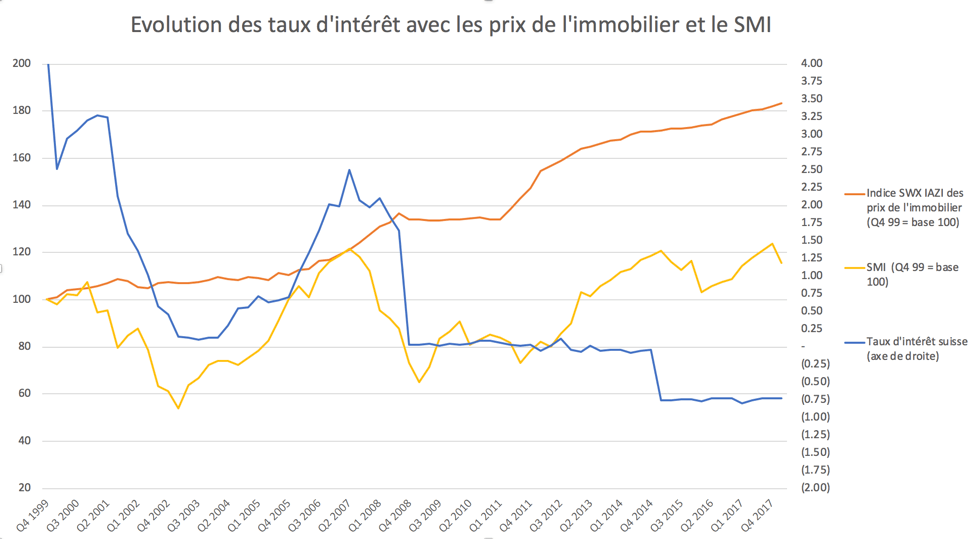

However, this needs to be put into context, since during this period there was the internet bubble and the subprime crisis. And, particularly during the second event, Swiss real estate had a role as a safe haven, partly thanks to the country’s positive economic climate. In addition, interest rates continued to fall throughout this period, increasing the attractiveness of real estate as can be seen in the graph below.

To sum up, on one hand, bonds and equities were less attractive, and on the other hand, net rental income from real estate increased largely due to the reduction in the mortgage burden indirectly linked to the fall in interest rates respectively the expansionary monetary policy of the Swiss National Bank over the period. This climate thus stimulates the current trend of ever-increasing attractiveness of real estate to investors.

Furthermore, given the performance of the asset classes in terms of their respective volatilities, if this trend continues, it could be that one day equities will be used as a diversification tool and not the other way round, as is the case today.

References

Données SIX. (2018, 06 29). Data centre. Source: https://www.six-swiss-exchange.com/indices/data_centre/customer/iazi_en.html

Kempen. (2017, 03). WHITE PAPER Listed and non-listed real estate investment – why combine the two? .

Ulrich Braun, Christian Braun et Zoltan Szelyes. (février 2017). Real Estate Strategies. Credit Suisse.